Retiring from the Sainsbury’s Section

Ready to take your benefits?

You can do it all online through our secure member portal, My Pension. On My Pension, you can quickly see what your benefits are worth online. Once you’re ready to take your benefits, you may also be able to apply online in just 20 minutes! Simply go to My Pension > Explore Your Benefits.

Your options at retirement

This guide explains the retirement options you will see if you log into My Pension > Explore your Benefits

Read guide

Real people, retiring today

Read our case studies of six people retiring from the Sainsbury’s Pension Scheme.

Read case study

How much is your pension worth?

Log in to My Pension to get an up-to-date retirement quotation.

Log inSome members of the Sainsbury’s Pension Scheme who have not yet taken their pension have the option, at retirement, to give up some future pension increases in return for a one-off increase to their pension. This is known as Pension Increase Exchange (PIE).

Not everyone is eligible for PIE, but you can see if it’s listed as an option for you when you log into My Pension. If you receive a retirement statement in the post, it’ll be shown on there, too.

Watch the video

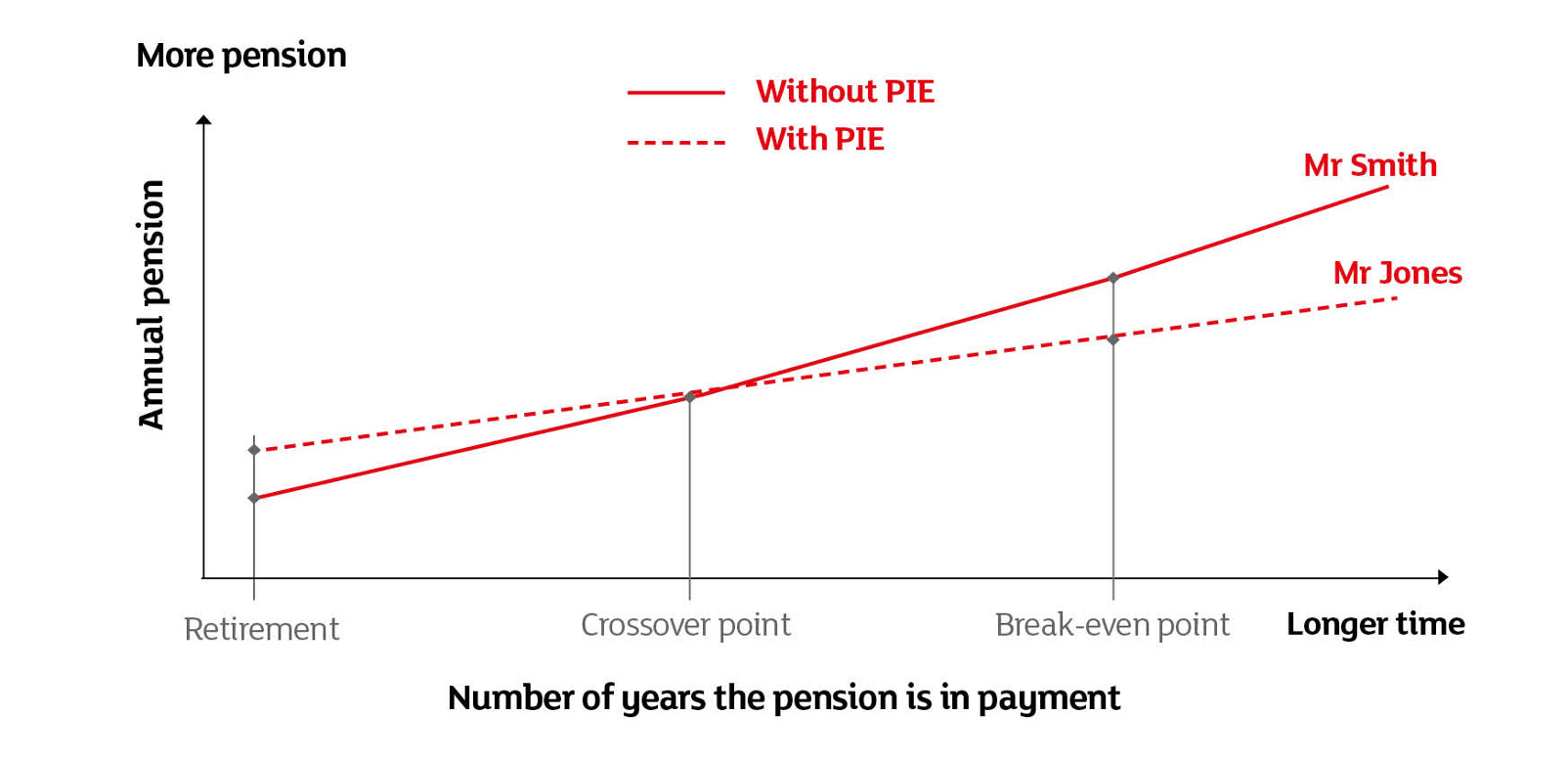

If you choose the PIE option, your pension would be higher at the beginning of your retirement. However, because it will then receive lower increases during your retirement, it might eventually end up being lower than what it would have been if you hadn’t chosen PIE. This is explained in the graph below, which compares two members with identical pensions.

- Mr Jones takes the PIE option, giving up future increases on his pre-1997 pension. This means he receives more money immediately after retiring than Mr Smith.

- As time passes, they reach the crossover point. This is where they receive the same amount of pension each year. This is because Mr Smith, who did not take the PIE option, has been receiving increases to his pre-1997 pension.

- Eventually we reach the break-even point, when both members have received the same amount of money in total pension payments since they retired.

What else do I need to know?

If you choose the PIE option, you can still take up to 25% of your pension as tax-free cash. Your spouse or civil partner will still get a pension from the Scheme, but part of their pension won’t receive increases.In our Scheme, you’re only allowed to give up increases on the pension you built up before April 1997. That means any pension built up between April 1997 and when you retire will still get increases.

Is PIE right for you?

Use our online tool to work out what your options under PIE might be. You’ll need a copy of your retirement statement to hand before you begin – or view it online through My Pension.

How do I know if the PIE option is right for me?

Neither Sainsbury’s nor the Trustee or Scheme administrator can provide you with advice on the PIE option. However, the Trustee is currently providing paid-for advice through LV= to help members understand their retirement options – which may include PIE.

The specialists at LV= can answer any questions you may have about PIE, to help you decide whether it’s right for you. They’ll look at your personal circumstances (such as how much you earn, how much tax you pay, your health and family situation) to help you make an informed decision.

Who can use the advice service?

Any member of the Sainsbury’s Pension Scheme who has not yet taken their retirement benefits can get in touch with LV=.

Do I need to pay LV= for advice?

No, if you want advice about whether or not to take the PIE option, the Sainsbury’s Trustee will pay the cost of this advice. LV= will provide impartial advice based on the right outcome for you and your personal circumstances. Even if you decide not to take the PIE option, you still won’t have to pay.

What happens in a PIE session with LV=?

You would have an initial ‘fact-finding’ phone call with LV=. This usually takes around 30 minutes, but could be longer or shorter, depending on your financial situation and how much support you need. Before your call, you would need details of your pension, the PIE offer you have had, and your financial information.

If you decide to proceed with advice, an LV= adviser will carry out a personal review and will present their recommendations based on your unique needs and circumstances for retirement. You don’t have to accept their recommendation.

How do I set up a call?

There is a dedicated LV= helpline and email address for Sainsbury’s members who want to talk about the PIE option:

Telephone: 0800 0223 855

Email: Sainsburyspensions@lv.com

You’re welcome to have any trusted party, for example your own adviser or family members, join you on the call when speaking to LV=.

By calling LV=, you’re not committing to anything. It’s your choice whether you take the PIE option. Neither Sainsbury’s nor the Trustees or Scheme administrator can provide you with advice on this option.

Some members may have paid Additional Voluntary Contributions (AVCs) to ‘top up’ their pension from the Sainsbury’s Pension Scheme. It’s no longer possible to pay new AVCs into the Scheme, but you can still manage your existing AVC pension pot.

All AVCs are now managed by Legal & General, and you will have access to their online portal, Manage Your Account, where you can see how much your pot is worth and make changes to your investments.

If you’re also a member of the Sainsbury’s Retirement Savings Plan (SRSP), you might already have an online account with Legal & General, and you’ll be able to see details of both your SRSP and AVC pots on Manage Your Account.

You will receive a statement every year, giving details of your AVCs and how they are invested.

Retiring takes time

When you tell us you want to retire, WTW will need to contact Legal & General to release your AVC funds. This sometimes can take some time, so it’s worth bearing this in mind and factoring it into your retirement plans.

Deciding what to do with your pension is a big decision. We strongly recommend you seek advice about your options. To help you with this, the Trustee has appointed LV= to provide an expert retirement guidance and advice service.

How does it work?

To help you make the right choices with your pension savings, the Trustee has agreed to pay for the cost of advice with a company called LV=. This means that LV= will provide retirement planning advice and guidance to members of the Scheme completely free of charge. Click here to find out more about LV=.

LV= can give you regulated and impartial advice about:

your retirement options from the Sainsbury’s Pension Scheme

whether or not to transfer your pension

whether or not to take the PIE option

flexible retirement options, including drawdown

buying an annuity

the options for any other pensions that you have

tax allowance issues (alongside retirement advice)

Visit LV=’s dedicated website

LV= has set up a dedicated website just for Sainsbury’s members, where you will find a full list of their services and details of how to access them: www.lv.com/sainsburys

From this page you can also meet the experts who form part of the LV= team. Each team member is passionate about pensions and they’re on hand to help if you need them.

How to get in touch with LV=

Using your own adviser?

When choosing your own adviser, make sure they’re authorised to give specialist pension advice by calling the Financial Conduct Authority (FCA) Consumer Helpline on 0800 111 6768. If you don’t use an FCA-authorised firm, you risk not having access to compensation schemes.

Open 8.30am to 5.30pm, Monday to Friday. For TextPhone dial 18001 first. LV= may record and/or monitor calls for training and audit purposes.

Useful documents

Real people, retiring today

Read our case studies of six people retiring from the Sainsbury’s Pension Scheme.

Read case study

LV= and your PIE option

As part of their Retirement Advice Service, LV= can also help members who are considering taking the PIE option.

Read guide